THDCIL’s ₹600 crore Corporate Bonds Series-XIII to be listed on BSE and NSE on 23 July 2025

Rishikesh: Reflecting strong trust and investor confidence in the stock market, THDC India Limited, a leading Schedule-‘A’, Mini Ratna Public Sector Undertaking, successfully concluded the bidding process for ₹600 crore under Series-XIII of Corporate Bonds on 18 July 2025. The process was conducted at THDCIL’s Corporate Office, Rishikesh, at a competitive coupon rate of 7.45% per annum through BSE-Electronic Bidding Platform. It is noteworthy that the issue received subscription 11 times more than the competitive rate, indicating strong investor confidence in THDCIL bonds.

Rishikesh: Reflecting strong trust and investor confidence in the stock market, THDC India Limited, a leading Schedule-‘A’, Mini Ratna Public Sector Undertaking, successfully concluded the bidding process for ₹600 crore under Series-XIII of Corporate Bonds on 18 July 2025. The process was conducted at THDCIL’s Corporate Office, Rishikesh, at a competitive coupon rate of 7.45% per annum through BSE-Electronic Bidding Platform. It is noteworthy that the issue received subscription 11 times more than the competitive rate, indicating strong investor confidence in THDCIL bonds.

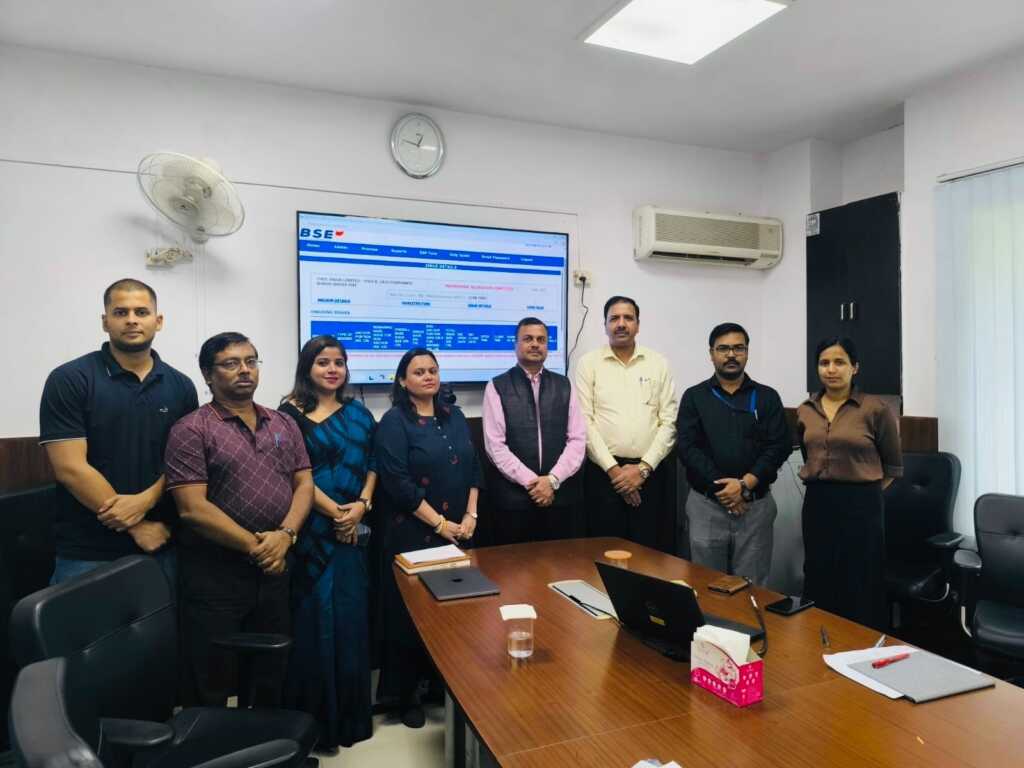

R. K. Vishnoi, Chairman & Managing Director, THDC India Limited K. Vishnoi said that the successful completion of Bond Series XIII reflects investors’ strong confidence in THDCIL’s strong infrastructure, prudent financial management and consistent operational performance. He emphasized that as a diversified energy PSU, THDCIL is continuously expanding its portfolio by entering various energy sectors, and the funds raised through this issue will further strengthen the company’s financial position and support its ongoing strategic projects. THDCIL Director (Finance) and CFO Sipan Kumar Garg informed that the issue consists of unsecured, redeemable, non-convertible, non-cumulative, taxable bonds with a base size of ₹200 crore and a green shoe option of ₹400 crore, making the total issue size of ₹600 crore. The tenure of this bond has been kept at 10 years. He further informed that the issue received an overwhelming response from the market, with subscription over 11 times the base issue size, reflecting investors’ strong confidence in THDCIL’s financial strength, prudent debt management and continued track record of operational excellence.

Sipan Kumar Garg, Director (Finance) & CFO, A.K. Garg, General Manager (Finance), Himanshu Chakraborty, Additional General Manager (Finance-Budget), Rashmi Sharma, Company Secretary, THDCIL and Hemlata Agarwal, BSE Head, Northern Region (Fixed Income) were present during the bidding process. The company currently has a rating of “AA Outlook Positive” from India Ratings and “AA Outlook Stable” from CARE Ratings, reflecting its strong financial position and credit profile. So far, THDCIL has issued a total of 13 series of corporate bonds and has successfully raised funds of Rs 10,442 crore from the corporate debt market. Investors have shown remarkable interest in all the bonds issued by THDCIL, reflecting the continued confidence of investors in the Company.